The export rebate rate for value-added tax on batteries has been lowered.

Ministry of Finance: The export rebate rate for value-added tax on battery products has been reduced to 6% as of April 1st. It will be completely abolished in 2027.

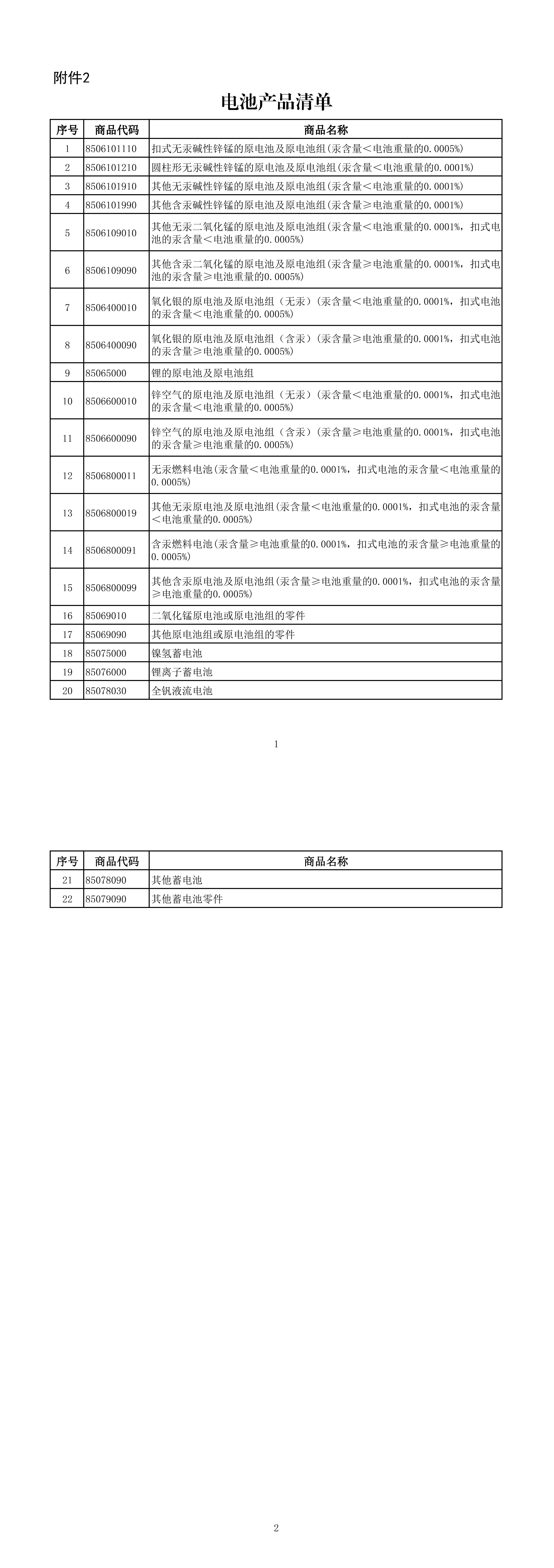

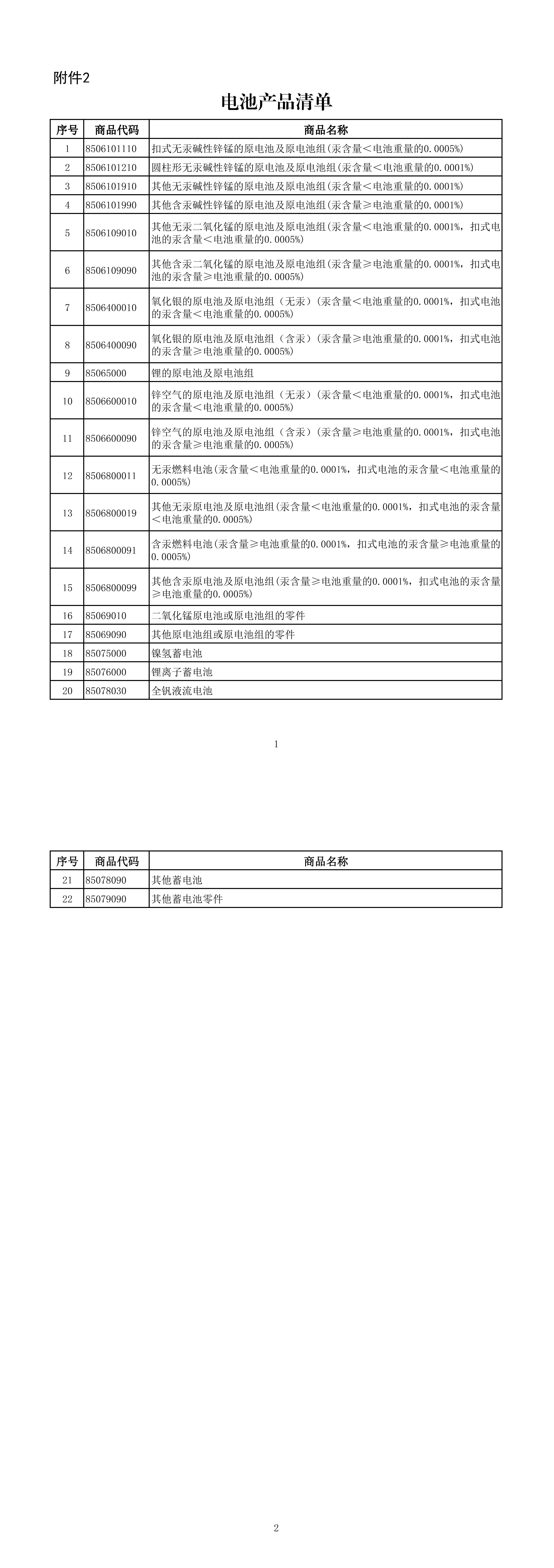

Introduction: On January 9th, the Ministry of Finance and the State Taxation Administration issued a notice on adjusting the export tax rebate policies for certain products: As of April 1, 2026, the export tax rebate for products such as photovoltaics will be abolished. From April 1, 2026 to December 31, 2026, the export tax rebate rate for battery products will be reduced from 9% to 6%; starting from January 1, 2027, the export tax rebate for battery products will be abolished.

The original notice is as follows: Regarding the adjustment of export tax rebate policies for photovoltaic and other products, the following announcements are made:

I. starting from April 1, 2026, the export tax rebate on value-added tax for photovoltaic and other products will be cancelled.

II. From April 1, 2026 to December 31, 2026, the export VAT rebate rate for battery products will be reduced from 9% to 6%; starting from January 1, 2027, the VAT export rebate for battery products will be cancelled.

III. For the products listed above that are subject to consumption tax, the export consumption tax policy will remain unchanged and the current consumption tax refund (exemption) policy will continue to be applied.

IV. The export rebate rate applicable to the products listed in this announcement is determined based on the export date indicated on the export customs declaration form.

This is to announce.

Ministry of Finance Taxation Administration

January 8th, 2026